Immense Untapped Global Biomethane Potential (According to the Latest from the International Energy Agency)

Background

Last week the International Energy Agency (IEA) released an incredible new report: Outlook for Biogas and Biomethane – A global geospatial assessment. Before diving into the findings of this landmark assessment, a little more on the IEA for those who are not familiar with the organization.

The IEA is based in Paris, France and plays an important role on the world stage as its member and association countries represent up to 75% of total global GDP. Per its website:

“The IEA examines the full spectrum of energy issues including… renewable energy technologies, electricity markets, energy efficiency, access to energy, demand side management and much more. Through its work, the IEA advocates policies that will enhance the reliability, affordability and sustainability in its 31 member countries, 13 association countries and beyond.”

This new report – following IEA’s 2020 assessment (Outlook for biogas and biomethane: Prospects for organic growth) – provides “a global perspective on the prospects for biogases, highlighting the huge untapped potential and scope for growth across advanced and emerging market and developing economies…. There is a growing recognition that biogases can provide broad, system-wide benefits when effectively integrated into the energy system. These include helping to sustain a circular economy while supporting energy security, economic and environmental goals.”

There are many advantages of biogas and biomethane production, including:

Emission Reductions: Significantly lowering greenhouse gas emissions, particularly methane, which is far more potent than CO2.

Energy Access: Providing reliable baseload (24/7) clean energy in remote and underserved areas.

Economic Development: Creating jobs and stimulating local economies, especially in rural areas.

Current Global Biogas/Biomethane Production

Today, biogas and biomethane represent a relatively small, niche application relative to the total global energy mix. Estimated 2023 global production was approximately 50 billion cubic meters (bcm), representing just 3% of all bioenergy or 1% of natural gas consumption. Nearly 80% of this total was in the form of direct on-site consumption to produce electricity and/or heat, with much of the remaining portion (8 bcm) upgraded to biomethane (aka renewable natural gas, RNG).

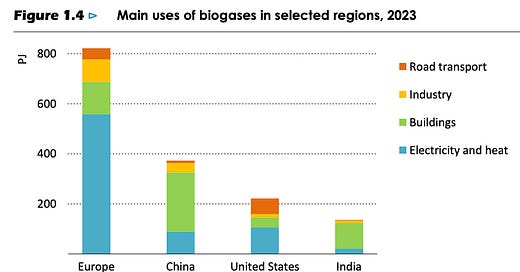

Not surprisingly, Europe accounts for close to 50% of total current production, followed by China, the US and India, which collectively produce 80% of the balance. (Total US production totaled 6 bcm in 2023, about half of which -- ~107 million mmbtu -- was upgraded to RNG.) The figure below provides a more detailed view of production by these four core regions as well as consumption by end use.

Source: IEA, Outlook for Biogas & Biomethane, 2025

Untapped Feedstock Potential

The IEA’s latest assessment looks at the technically feasible global potential to “sustainably produce” biogas and biomethane (RNG) from four primary sources of organic waste:

Crop residues (e.g. wheat straw, corn stover, etc.)

Livestock Manure (dairy/beef, swine, poultry)

Biowaste (including food waste and wastewater)

Woody biomass (e.g. log residues and wood processing waste)

Most notably, this is the first known global assessment of waste feedstocks suitable for biogas/biomethane production that includes detailed geospatial analysis to indicate country- and region-specific potential.

Here is the breakdown of feedstock potential by type and region, according to IEA (“advanced economies” are primarily the US, Canada and EU):

Source: IEA, Outlook for Biogas & Biomethane, 2025

If fully realized, the total global potential for RNG production is quite compelling, estimated at approximately 990 billion cubic meters per year, or close to 35 billion mmbtu/year. This is nearly a 20-fold increase from current production levels. (To put these figures in perspective, approximately 140 bcm of natural gas is flared today, according to separate IEA research findings.)

For reference, this level equates to roughly 25% of total global natural gas demand (which McKinsey estimates to be close to 4,000 bcm); or 240 billion gallons of petroleum (21% of total demand, which is approximately 1.13 trillion gallons).

A further breakdown of feedstock potential suggests:

The largest portion by far of untapped potential is in the realm of crop residues, representing approximately 280 billion cubic meters (bcm) of RNG production per year, predominantly in emerging markets/developing countries .

Livestock manure is the second largest opportunity, at approximately 460 bcm.

Biowaste is the third largest feedstock supply, accounting for ~160 bcm.

Conservative estimates for woody biomass peg its potential at ~80 bcm.

Untapped US Potential

Of all the “advanced economies” in the world, the US has by far the largest share of untapped biogas/biomethane potential, estimated to be approximately 100 billion cubic meters per year (or roughly 3.6 billion mmbtu). This represents a more than 16-fold increase from current production levels. If this full potential were realized – in the form of RNG – it would equate to almost 11% of total US natural gas demand. Alternatively, in comparison to total annual transportation fuel consumption, 3.6 billion mmbtu of RNG could displace approximately 23 billion gallons of the ~72 billion gallons of diesel/distillate fuel consumed across all modes of transportation – trucks, ships, trains, planes, etc. (2022 data).

Here is how the untapped RNG potential compares to each of the primary segments that make up the total US transportation fuel demand pool:

Medium & Heavy Trucks: ~46B gallons/yr

Aviation: ~19B gallons/yr

Rail: ~4B gallons/yr

Marine: ~3B gallons/yr

It is not likely realistic to assume that the total technical untapped RNG potential will be unlocked, even by 2050, but continued progress in transforming these “waste” feedstocks into energy and fuel can have a meaningful, outsize impact in decarbonizing various “difficult-to-electrify” segments of the economy. And collectively, between both existing (and growing) natural gas and transportation fuel consumption, there is no shortage of demand for sustainably produced and cost-effective low-carbon fuels like RNG. The biggest obstacles to realizing this potential lie within the realm of markets, policy and regulation (see below).

For more on country- and feedstock-specific untapped biogas/biomethane potential, here’s a great graphic overview.

Source: IEA, Outlook for Biogas & Biomethane, 2025

Policy & Market Considerations

The report emphasizes that realizing the full potential of biogas and biomethane requires:

Supportive Policies: Financial incentives, streamlined permitting, and sustainability criteria. Over 50 new policies have already been introduced to support biogases since 2020, including in the EU, China, Brazil, India, and other countries.

Cross-Sector Collaboration: Engaging stakeholders across energy, agriculture, and waste sectors. This type of collaboration can lead to truly sustainable, circular economy systems.

Investment in Technology: Improving efficiency and reducing costs of production and upgrading. Economies of scale can lower costs and “unlock” additional feedstock resources.

Public Awareness: Educating communities about the benefits to encourage participation. This is a key component and cannot be overstated, especially as community opposition fueled by misinformation can thwart progress anywhere.

Outlook to 2050

The IEA analyzed two scenarios to 2050: one in which only the current policies are in place, and one in which all stated pledges are met. In both cases, biogas and biomethane are projected to play a crucial role in achieving climate goals, but particularly in the latter case of countries meeting their more ambitious climate pledges.

While less than 5% of the total sustainable potential for production of biogases (990 bcm) is being realized today, the report estimates that 17% (~170 bcm) would be used globally by 2050 in the current policies scenario and 25% (~250 bcm) in the all pledges met scenario. Progress is expected to be uneven; for example, in China and Europe, some biogas feedstock potentials are fully exploited.

Overall, including in the US, there is tremendous untapped potential for biogas and biomethane production. This IEA report is a valuable new resource for policymakers around the world, coming from arguably the leading source of energy sector expertise internationally, providing a wealth of country-specific information. It’s now up to all countries to seize this opportunity to rethink and transform “waste” into the valuable resource it is.